Challenges of Flexible Circuit Assemblies

Are you finding it challenging to procure suitable flexible circuits? It’s a fast-changing industry, and it can be difficult to stay up-to-date on the latest trends. This guide explains everything you need to know to have a complete understanding of the challenges associated with manufacturing flexible circuits. It will provide you with the information you need to find the right supplier for you.

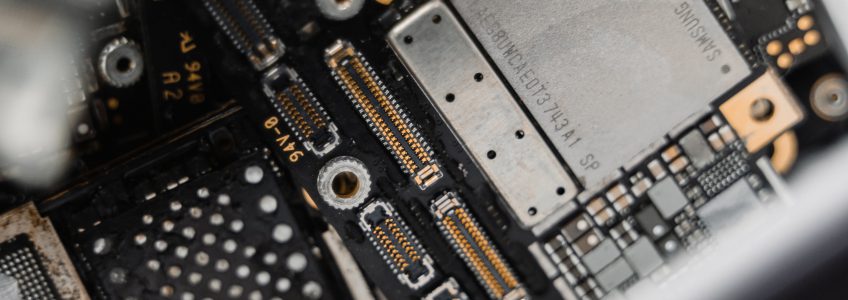

What are Flexible Circuits?

Flexible circuits, also known as flex circuits, are electronic circuits made of flexible materials such as plastic and polyimide. They are widely used in various industries, including aerospace, medical, and automotive, because of their ability to bend and conform to different shapes and sizes.

What is the Demand for Flexible Circuits?

According to a recent report by Maximize Market Research, the global market for flexible circuits was $32.65 billion in 2022. That’s expected to grow by 8.23 percent annually to $56.81 billion in 2029. Companies that use flexible circuits could find it challenging to procure the components they need as demand increases.

What are the Challenges Associated with Manufacturing Flexible Circuit Boards?

The assembly of flexible circuits presents several challenges that manufacturers must overcome to ensure reliability and functionality.

Equipment Challenges for Manufacturing Flexible Circuits

One of the biggest challenges of flexible circuit assembly is how complex the process is. Unlike rigid circuit boards, which are typically built using automated machines, flexible circuits require additional tools to utilize the automated equipment because of their flexibility. These added tools and processes reduce the risk of errors and defects, which could lead to costly rework or even product failure.

Flexible Circuits: Design Challenges

The design of flexible circuits can also pose challenges during assembly. Flex circuits often have complex and intricate designs that require precise assembly techniques to ensure their functionality. The design must also take into account the flexibility of the circuit board, which can affect the placement of components and the routing of traces. This requires careful planning and coordination between the design and assembly teams, which requires highly skilled designers and operators.

Flexible Circuits: Material Requirements

The materials used in flexible circuit assembly also present challenges. Flexible circuits are often made using thin and delicate materials that require careful handling to avoid damage. In addition, the material must be able to handle the high temperatures needed to solder components on the circuit without any damage to the circuit itself.

In short, you need a manufacturer that understands the complex material requirements of building circuit boards.

Circuit Boards: Dependency on Experienced Talent

The final challenge of flexible circuit assembly is the need for highly trained personnel. It requires designers and operators who understand the process very well and can plan the tools accordingly, as each circuit has its own unique requirements.

Additionally, the manufacturing equipment must be regularly maintained by experts to ensure it remains in good working condition. It may need to be adjusted periodically during the assembly process.

Flexible Circuit Boards: The Bottom Line

In conclusion, the assembly of flexible circuits presents several challenges that manufacturers must overcome to ensure their reliability and functionality. These challenges include the complexity of the process, the need for specialized equipment, the design of the circuit and the materials used, and finding the right people to get the job done. However, with proper planning, training, and equipment, the best manufacturers can successfully assemble flexible circuits that meet the needs of their customers.

Exploring Multi-Layer PCBs: Benefits and Applications

Printed Circuit Boards are the backbone of modern electronic devices, to say the least. Single-layer PCBs are widely used, though as technology evolved, the demand for more complex PCBs increased. Multi-layer PCBs have played an integral role in fulfilling this need for more complex electronic systems and they come with many benefits.

Multi-layer PCBs can have between 3 and 20 layers. The more layers, the more density of components and interconnections is allowed. More layers actually have made it possible for smaller yet more powerful technology to be made, like power planes, ground planes, signal layers, smartphones and tablets, automotive electronics, aerospace systems, and many more technologies. Additionally, they can reduce assembly costs by allowing the integration of other components like microcontrollers, sensors, and memory modules on a single board.

Multi-layer PCBs also reduce electromagnetic interference (EMI) and noise issues. This makes them ideal for complex electronic applications like motherboards and radio frequency boards.

These PCBs also have great signal integrity. Additional layers allow for shorter and more direct signal paths, reducing the possibility of distortion and signal loss. High-speed applications need this type of reliability for better data transfer rates and reduced transmission errors.

Have we convinced you yet that multi-layer PCBs are great? Because there are even more benefits. These PCBs offer improved thermal management, so there is more surface area for heat dissipation which works great for hot components or cooling mechanisms. Efficient thermal transfer prevents overheating and extends the lifespan of the components in tough environments.

Multi-layer PCBs really revolutionized the field of electronics with all these benefits and expanded the use of more compact electronics. This type of PCB will remain at the forefront of developing more sophisticated technologies.

Tramonto Circuits has many years of experience working with multi-layer PCBs and can help you with your manufacturing project. Contact us today for help with your multi-layer PCB design.

The Evolution of Circuit Board Manufacturing Techniques

As the technology in which circuit boards are used has evolved, so have the circuit boards themselves. We won’t age ourselves, but at Tramonto Circuits, we have seen circuit board manufacturing change in many ways since we opened up for business.

Did you know that the earliest circuit boards were made using a technique called point-to-point construction? This involved manually wiring components together on a board. Can you imagine how long that took? Likewise, it posed the risk of human error. Engineers began seeking and testing solutions that would open the doors for mass production.

This led to a production technique called wire wrap. This meant wrapping wires around posts on the circuit board and soldering them in place. This was an improvement, but this process still required too much skill and time.

Enter the 1960’s, the era of printed circuit board (PCB) manufacturing. PCB manufacturing prints a circuit pattern onto a board using a photographic process, then etching away unnecessary remaining copper to leave behind the essential circuits. PCB manufacturing remains the industry standard, but this production method, of course, has also evolved since the 1960’s.

The 1980’s presented surface mount technology, which allowed components to be mounted directly onto the board’s surface, rather than being inserted into holes. This technology played a huge role in making circuits more compact and it brought the process much closer to automation.

Now, PCB manufacturing is hugely automated, but it still involves multiple stages. There is software to create the circuit design, there are special printers to print it on the board, there is a machine that applies a solder paste, and machines that place the components on the board. There are also specialized ovens to melt the solder. Technology has significantly improved the process and quality of circuit boards.

We are currently on the cusp of what could be a new era of PCB manufacturing, and that is the 3D printing era. It is still being heavily tested and explored, but it could revolutionize the process and allow for more complex designs.

When working with a partner to manufacture your circuits, you want a trusted company that knows all the ins and outs of circuit design. Contact Tramonto Circuits for true expert advice every step of the way.

How to Properly Test Functionality of Electronic Circuits

The smallest malfunction in a circuit can have significant consequences, especially when going through the manufacturing process. Testing is a huge part of what we do at Tramonto Circuits because we want our customers to safely avoid setbacks that will delay their product getting to market. Here are some of the best practices we employ when it comes to testing electronic circuits.

Visual inspection

We always first check for any loose connections, damaged or burnt components, or signs of physical damage. All components should be in their correct locations, too, and there should be no short circuits between the tracks.

Power-up

We then connect the circuit to power and switch it on, using a multimeter to measure the voltage to make sure it is operating within the expected range.

Functionality test

We will simulate the circuit’s operating conditions and verify that it performs as it will be intended. We take into account all factors of what this circuit’s purpose will be, including temperature and other environmental factors, timing, sensors, and more.

Long-term reliability

A circuit has to continue to function correctly over an extended period. Therefore, we’ll subject the circuit to continuous operation for several weeks to check for any failures.

Thorough electronic circuit testing can save time, money, and even lives. Work with Tramonto Circuits to make sure your next project is in good hands.

3 Common Sources of Manufacturing Delays

The year is 2023 and all we seem to continue hearing about is one supply chain crisis after another. Tramonto Circuits has been around long enough to see and adapt to other world crises. A global pandemic, of course, is one major source of manufacturing delays. However, there are themes that most frequently can be the source of delays, no matter what is going on at the current point in history. Here are those common sources of manufacturing delays to look out for.

Late Shipments

Limitations in raw materials or components can lead to late shipments and if workers don’t have what they need, they can’t move forward and there will be a slowdown in production. This can also lead to an increase in inventory costs as finished goods cannot be shipped out until the missing items arrive.

RFQ’s

A Request for Quote (RFQ) helps allow a supplier to maximize their sales at an appropriate price point, considering all variables. These RFQ’s can cause manufacturing delays if the process of gathering quotes from suppliers takes too long. Sometimes an RFQ process can result in selecting a supplier who cannot deliver on time, further adding to the delay.

Order Acknowledgements

Order acknowledgments are simply the process of confirming and verifying customer orders. If they’re not completed in a timely manner, that can cause delays on top of confusion about details and the need for clarification. Even worse, inaccurate information on the order acknowledgment can also cause production errors that then lead to rework.

The team at Tramonto Circuits has learned a lot about these common delay triggers and has mastered mitigating these risks as best as we can. We’ve prioritized quick quotes and get 24-hour quotations done 98.9% of the time. Our on-time delivery rate is 98.15% because we know to look out for these risks and do what we can to prevent them. Move your manufacturing project along at the rate you want it to by working with Tramonto Circuits today.

What Data is Required for a PCB Design Quote?

Tramonto Circuits provides 98.9% of its quotes within 24 hours. To put it simply, we’ve nailed down the quote process for PCB design pretty well over the years. Here’s what you should expect to be able to provide in order to get the most accurate quote for your PCB design project.

Schematic

No matter what stage of development your project is at, one bare minimum requirement your PCB provider will need to know so that they can lay out services is a schematic. This can be a simple JPG or a full CAD schematic file. Just make sure your resolution is high enough so that the information is legible.

Bill of Materials (BOM)

BOMs most frequently come in Excel spreadsheets but other files are acceptable. This should list each component that will be used in the assembly. Even better if you can include the manufacturer, part number, and quantities. Missing details may lead us to ask for more specific information because these details will affect the amount of surface area required and layer count.

Placement Drawing

A basic dimensional view that shows the X-Y dimensions of the PCB will help your provider understand how the available PCB surface area will be organized. The more dimensions you can provide, the better, but for the most part, a basic model showing the locations of components will go a long way. These drawings are often called “key placement” documents, too.

Tramonto Circuits has a handy file upload on its quote submission form to allow users to provide this information to help guide us to an accurate quote for you. Submit yours today and get your quote within 24 hours.

3 Tips for Working Through Supply Chain Issues While Manufacturing

Manufacturers of all types have experienced quite their share of supply chain hiccups in recent years. At Tramonto Circuits, we’ve gone through many years of experience working around all kinds of disruptions in the world and managed to maintain top-notch delivery rates and quality for our customers. Here are our suggestions for how you can best navigate through supply chain disruptions during your manufacturing process.

Tip #1: Find a trusted partner with great delivery rates

The times sure have changed and this time in the history of supply chain issues is not the same as others. However, a company with a track record of experience working through shortages is going to be your best bet. When seeking a trusted manufacturing partner, ask what their on-time delivery rate is. Tramonto Circuits has a 98.15% on-time delivery rate, even through the delays of today.

Tip #2: Use predictive analytics where possible

Do you know yet exactly how supply chain levels may affect your project’s timeline? Predictive analytics can give you insights into buyer patterns in relation to all kinds of disruptions so you know how supply levels can affect your retail sales. Tramonto Circuits helps its partners know what they can expect along their manufacturing journey based on many years of experience.

Tip #3: Always start with a DFM analysis

Get your circuit files and anything else reviewed by an expert so that you know in advance what standards need to be met. This analysis will set your expectations for how your manufacturing process should go in light of current events and supply chain delays. Tramonto Circuits offers this guidance to circuit designers for free.

Contact Tramonto Circuits today to get your circuit manufacturing project moving forward in the best way it can.

How to Truly Ensure High-Quality Electronic Assembly

One of the biggest challenges manufacturers face when they partner with teams to bring a product to conception is quality assurance. When a design engineer sends something off for assembly, they need to be able to rest assured that what they receive in return is going to reflect the quality they had envisioned.

Choosing the right manufacturing partner is the first step in ensuring that your product will be both the utmost in quality and compliance. Tramonto Circuits has a few ways of making sure of that, all the while consistently achieving a 99.83% quality ratio. Here are some:

Routine electronic assembly quality assurance techniques

Work with a partner who truly has a routine for this and has done it many times. We consistently conduct component testing and regular data backups and evaluate new production methods to ensure accurate products are produced with minimal waste. This also provides you with more cost-effective solutions.

Low defect rate

Look for a low defect rate with your manufacturing partner. Efficiency, timely manufacturing, and avoiding waste are all extremely important, but only if they are simultaneously producing low defect rates.

Attention to every detail

An engineer will almost always want their PCB to be ready for immediate use upon delivery. His or her manufacturing partner ensures this with a team of certified engineers and expert production staff that provides efficient electronic component builds. Tramonto Circuits has this reliable team to provide precision quality assurance at both the board and system levels.

Contact Tramonto Circuits today to get your quality product to completion with peace of mind.

Why Implementing an ISO 9001 Quality Management System is Essential for Business Success

If you’re not familiar with ISO 9001, it’s an international quality management standard that helps businesses ensure that their products and services meet the needs of their customers. In other words, it’s a way of making sure that your company is run in a more efficient way. Here’s why becoming ISO 9001 certified is so important.

All About Continuous Improvement

One of the big advantages of ISO 9001 is that it’s based on the idea of continual improvement. That means that once you attain your quality objectives, you don’t just sit back and relax. Instead, you continue to strive for even better results. As a result, certified organizations are better able to meet customer requirements and deliver high-quality products and services. This leads to improved customer satisfaction and loyalty.

Enhanced Marketability

In today’s competitive marketplace, customers often seek out organizations that are ISO 9001 certified when looking for goods and services. By becoming certified, you can enhance your marketability and competitiveness, giving you a leg up on the competition.

How ISO 9001 Is Implemented

One of the great things about ISO 9001 is that it can be used by any type of organization, no matter what size or in what industry. That’s because the standard is flexible and doesn’t specify targets for quality or customer needs. Instead, it’s up to each individual organization to set its own objectives and improve its processes accordingly.

The Benefits of Certification

Once you’ve achieved certification, you’ll be able to show your customers that you’re committed to providing them with high-quality products and services. This can give you a competitive advantage and help you attract new business. Additionally, certification can help improve morale among your employees by showing them that their work is important and valued.

Recently, Tramonto Circuits received our ISO 9001 certification. Tramonto Circuits is a leader in electronic components manufacturing. Our capabilities are flexible circuits, printed circuit boards (PCBs), flexible heaters and other custom-design components products for almost any circuit board needs. We are a company that understands the importance of personal touch. Unlike other printed circuit board manufacturers, you will not be speaking to a sales representative when reaching out; instead, you will speak with engineers who talk with you directly about your specific needs and solutions.

From the very beginning, we discuss your needs, develop a solution, create a process, and keep you informed every step of the way. There’s never a surprise and with our 99.4% on-time success rate and a 99.8% quality ratio, you know from the beginning that you are working with the best. To us, being ISO 9001 means one thing; that you, our client, are our number one priority. Reach out today to see the Tramonto Circuits difference and how we can help shape more of your business.

Four Circuit Board Specifications to Consider

When it comes down to the specifics of designing your circuits, there are certain things to consider. Make sure your design partner knows the answer to your questions before getting too far in on your flexible circuit or printed circuit board design project. Think ahead about the following details to ensure you’re set up for success with your manufacturing partner.

Minimum trace width

Your manufacturing partner should know what the flexible circuit minimum trace width is in order to make your design. The flexible circuit minimum trace width is 4-5”. Tramonto Circuits can get down to 3” for traditional circuit boards.

Maximum layer count for your circuits

Ask your circuit design partner what they are comfortable with as far as layer count for your specific circuit. At Tramonto Circuits, we are comfortable in the six-layer range for flexible circuits and we have built up to ten layers. For circuit boards, we can go all the way up to 20 layers.

Limitations and/or possibilities

A common question we encounter is whether our client can attach components or heat-sinks to flexible circuits. Tramonto Circuits’ answer is yes, we do this every single day because flexible circuits are so widely used that making this possible was a must.

How much current do you need?

A flexible circuit can actually carry about as much current as a printed circuit board can carry. Ask your circuit design partner how many milliamps the design will hold.

Contact Tramonto Circuits today to help you find the answers to these questions for your circuit design.